IT’S TIME TO EXPLORE FOR HIDDEN LOSSES!

Hidden Losses are Everywhere – In Equipment, in the Organization, even in the Management System.

Your Accounting System Doesn’t Reveal Them, but You Can Find Them If You Know Where to Look.

RENAISSANCE THINKING AND OPTIMIZATION

The Renaissance Period was rooted in a desire to explore and discover new knowledge. Renaissance thinking focused on discovering “what was unknown, overlooked, missing or misunderstood”. Let’s use some Renaissance Thinking to understand what’s missing from a traditional optimization scope. What’s missing is the root cause of why you can’t achieve “best possible” performance right now! If you know what’s missing, you gain a broader perspective about why “best possible” results is an elusive goal and what you need to do to fill the gaps so you can achieve and sustain that goal long term. Learning why profit potential is trapped/hidden and why barriers to optimization exist in your organization and management system is Step One in your journey to sustainable “best possible” results.

One barrier to optimization that is rarely discussed or recognized is the data that’s MISSING from every company’s tool set… data linked to what’s possible to achieve… to your “best” performance… to optimization. Let’s explore the reason for that…

WHY ARE OPTIMIZATION METRICS MISSING FROM MANAGEMENT’S TOOL BOX?

In the 21st century, why are optimization metrics missing from the financial system? To find the answer to this question, Kay decided to explore the history of accounting… when it was developed, who developed it and why it was created. Kay discovered a fascinating story that goes back 800+ years and involves places and people you know!

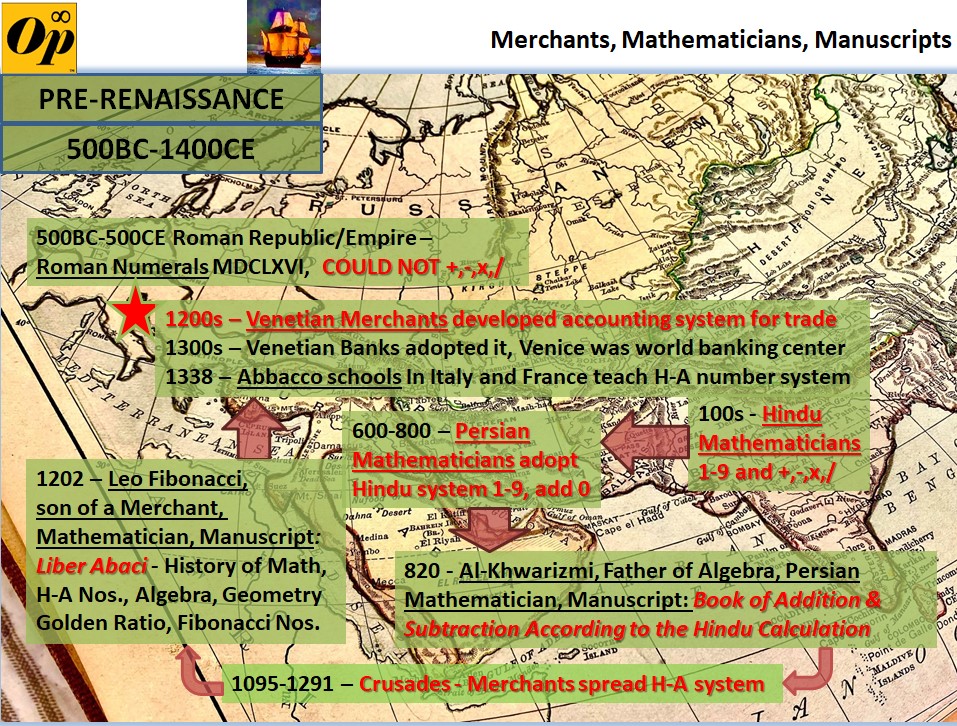

THE HISTORY OF ACCOUNTING… Merchants, Mathematicians and Manuscripts all Played a Role

Numbers Came First, Then Accounting in the 1200s

Roman numerals was not used for accounting because addition, subtraction, multiplication, and division were not possible.

The Hindu-Arabic numbering system was used to develop the accounting system because addition, subtraction, multiplication, division were possible.

In 1202, Fibonacci’s Liber Abaci manuscript helped spread knowledge of the Hindu-Arabic number system to Venice, where the accounting system was developed by Venetian merchants to track trade transactions in the 1200s.

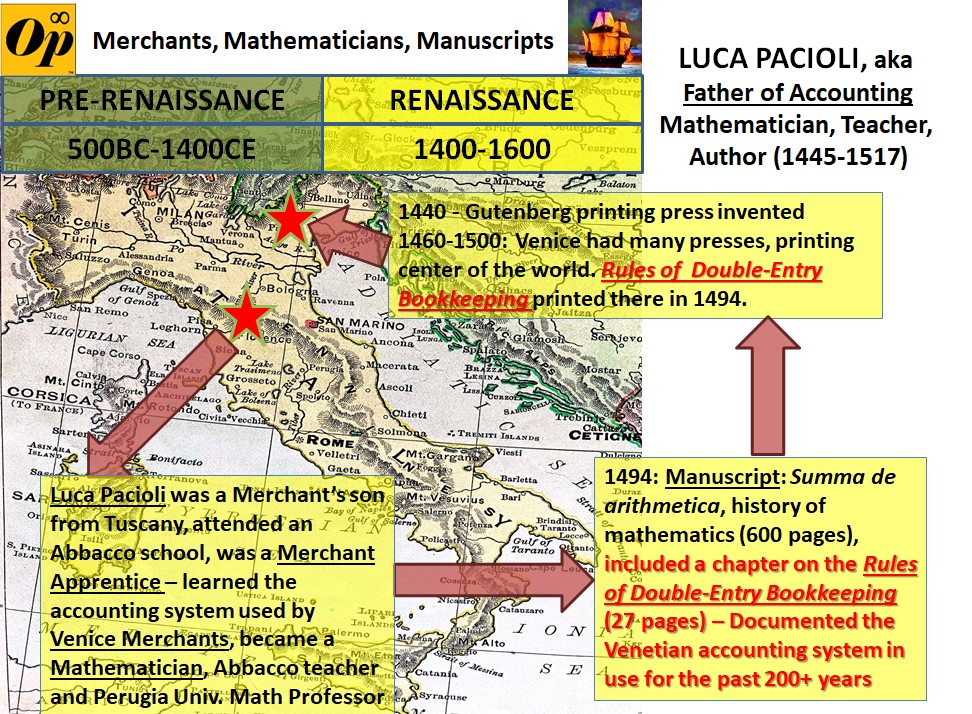

Over 200 years later, Luca Pacioli, the Father of Accounting, documented the accounting system developed in Venice. His 27-page treatise titled Rules for Double-Entry Bookkeeping was completed and printed in 1494 in Venice on the Gutenberg printing press. es were brought to Venice.

Pacioli’s Accounting Rules included guidelines and formats for debit and credit journal entries, inventory lists, trial balance, balance sheet, profit/loss calculations, income statement, procedures for managing inventories, stores, banking transactions and money exchange,and insurance on goods.

Accounting System was Documented/Printed in 1494

27 PAGES THAT CHANGED THE WORLD

In the 1500s and 1600s, merchants viewed books as commodities for trade and distributed them all over the western world. Pacioli’s Rules for Double-Entry Bookkeeping was translated into many European languages and became the standard for accounting procedures in many European countries. Starting in 1760, Pacioli’s Accounting Rules facilitated the financing required for the Industrial Revolution. They also provided a process for tracking money flow through industries such as railways, electric light systems, mining, and the shift from merchants to factories and mass production. In the 1800s, Pacioli’s Accounting Rules were used to track Stock Market transactions and Bank System transactions. Accountants and auditors became professions during this century. In the 1900s, Pacioli’s Accounting Rules made it possible to create corporations and shareholder reports. Today, with only a few enhancements over time, the basic accounting rules created 800 years ago by merchants and documented by Pacioli in 1494, are still serving industries world-wide 500 years later.

Historical References for the History of Accounting Section: “The Rules of Double-Entry Bookkeeping” by Luca Pacioli, 1494 (English translation edited by Michael Schemmann, 2010), “Double Entry – How the Merchants of Venice Created Modern Finance” by Jane Gleeson-White, 2011

THE OPTIMIZATION DIS-CONNECTION – What Did We Learn on This Journey?

By exploring the history of accounting, we learned that the 800-year-old accounting system we use today still works great to track “buy and sell” transactions and budgets linked to that activity. However, if your goal shifts to Achieving Optimization, (i.e., “best possible” performance), we learned the financial system lacks data and reporting needed to achieve that goal because it was NEVER DESIGNED for that purpose.

- Buying and Selling metrics are NOT THE SAME as metrics for “best possible” performance.

- Measures of success are different for achieving budget and achieving optimization/”best” results.

- BUDGET: Management’s goal is achieving the plan. If you achieve budget, the budget variance = 0.

- OPTIMIZATION: Management’s goal is to achieve optimization/”best” results. If you achieve “best possible”, the variance between “best” and actual = 0.

OPTIMIZATION METRICS… The Good News

It is possible to calculate Optimization Metrics to discover, quantify and capture your hidden operating/financial potential. Once you have the numbers, many doors are opened. You will have NEW KNOWLEDGE/INSIGHTS about your business:

-

You will know “How Good You Can Be”!

-

You can offer NEW SOLUTIONS to Old/Recurring Problems.

-

You can UNITE PEOPLE under “Best Possible” Goals.

-

You can achieve “BEST” RESULTS without investing in new equipment or systems.

IT’S TIME TO EXPLORE FOR MORE…

A company’s first barrier to Optimization is an unwillingness to EXPLORE FOR MORE! If your team believes they already have all the data they need to achieve “best possible” performance/optimization, they will

- REJECT THE OPPORTUNITY to explore for hidden dollars they are leaving on the table.

- FALSELY ASSUME that ACTUAL/BUDGET data can be used to achieve “best” results.

- NEVER KNOW how much MORE PROFIT they could have delivered to the bottom line.

Your WILLINGNESS TO EXPLORE is your first step in MINIMIZING YOUR FUTURE RISK OF LOSS.

DON’T BE AFRAID to take that step… you are likely to find MORE HIDDEN PROFIT POTENTIAL than you imagined!

CONTACT KAY TODAY to Begin Your Optimization Journey!

OPPORTUNITY: The only element with an infinite atomic number and weight. An odorless invisible element defined as a hidden or substandard set of circumstances in business that, when not acted upon, creates invisible losses that reduce profit. These losses can be eliminated by management when linked to beliefs, behaviors and numbers that drive the corporate culture, yielding a desirable green substance found in financial institutions.